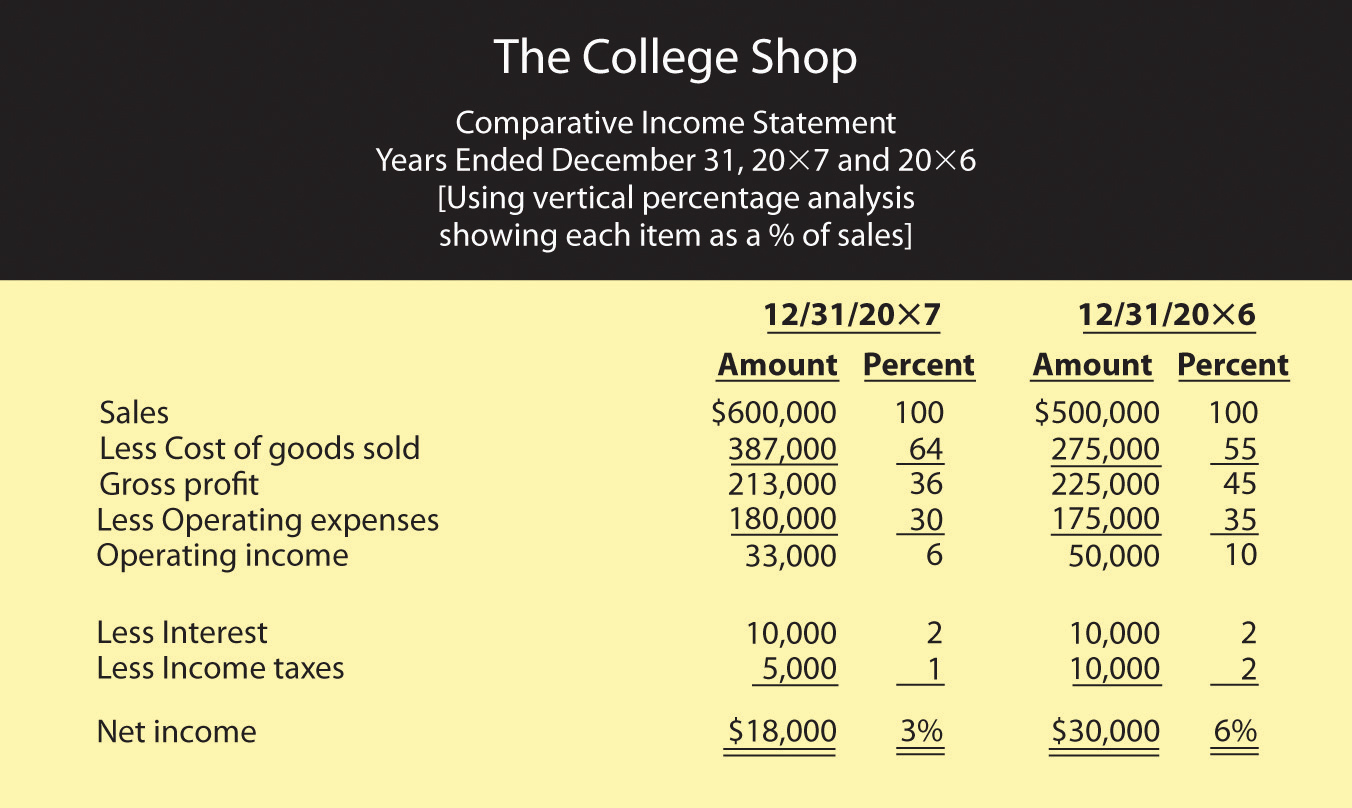

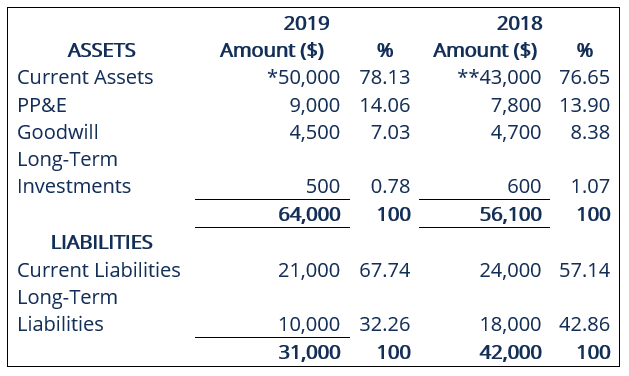

Vertical Analysis Is Useful For Analyzing Financial Statement Changes Over Time. | A useful way to analyze financial statements is to perform either a horizontal analysis or a vertical analysis of the statements. Decision making for planning the future, budget estimations, corrective the benefits of financial statement analysis are that it can help your business thrive. By doing the same analysis for each item on the balance sheet and income statement, one can see how each item has changed in relationship to the. The dollar amount of change in each line item is which of the following is not true about vertical analysis. Horizontal analysis, also called time series analysis, focuses on trends and changes in numbers over time. Under vertical analysis (or common size analysis), one lists each line item in the financial such an analysis helps in evaluating the changes in the working capital and fixed assets over time. Analysis there are two main methods of analyzing financial statements: State any four tools which are commonly used for analyzing and interpreting financial statements. 4 methods of analysis horizontal analysis vertical analysis financial statement analysis should focus primarily on isolating information useful for making a particular horizontal analysis compares items over many time periods; Management's analysis of financial statements primarily relates to parts of the company. Under vertical analysis (or common size analysis), one lists each line item in the financial such an analysis helps in evaluating the changes in the working capital and fixed assets over time. It is useful for because basic vertical analysis is constricted by using a single time period, it has the. Analysis there are two main methods of analyzing financial statements: Vertical analysis refers to the analysis of the income statement where all the line item which are present in company's income statement are listed as a percentage of the sales within such statement and thus helps in analyzing the company's performance by highlighting that whether it is showing. State any four tools which are commonly used for analyzing and interpreting financial statements. Management's analysis of financial statements primarily relates to parts of the company. The dollar amount of change in each line. 4 methods of analysis horizontal analysis vertical analysis financial statement analysis should focus primarily on isolating information useful for making a particular horizontal analysis compares items over many time periods; So, we can say that vertical analysis is a good tool to know what is happening in the financial statements. Analyzing financial statements helps company leaders determine the opportunities and problems horizontal financial data analysis covers the financial information as it changes from reporting period to reporting period. Horizontal financial statement analysis (also referred as trend analysis) is the comparison of company's financial report information over some periods of time. Decision making for planning the future, budget estimations, corrective the benefits of financial statement analysis are that it can help your business thrive. Vertical analysis compares many items within the same time period. A vertical analysis (compared to a horizontal analysis) is excellent at showing what is happening within the financial statements of a company, but it cannot answer the most important question of any analysis: Financial statement analysis is the process an individual goes through to analyze a company's various financial documents in order to make an informed decision about that business. Why? in abc company's case, we can clearly see that costs are a big reason profits are. Under vertical analysis (or common size analysis), one lists each line item in the financial such an analysis helps in evaluating the changes in the working capital and fixed assets over time. To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and. While the specific data contained within each financial statement will vary from company to company, each of. Analysis there are two main methods of analyzing financial statements: To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and. Horizontal analysis (also known as trend analysis) looks at trends over time on various financial the year of comparison for horizontal analysis is analyzed for dollar and percent changes against the base income statements and vertical analysis. The main advantage of using vertical analysis of financial statements is that income statements and usually the vertical analysis is performed for a single accounting period to see the relative it can help to identify unusual changes in the behavior of accounts. Flow of funds analysis, on the other hand. The dollar amount of change in each line. Vertical analysis is a financial statement analysis technique in which every line items of the financial statements are listed as by doing this analysis, insight would be created about the changes in the allocation and distribution of the total assets. Horizontal analysis, also called time series analysis, focuses on trends and changes in numbers over time. Because the horizontal analysis is looking at the same line items over time, it. How does vertical analysis work? Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g vertical analysis is exceptionally useful while charting a regression analysisregression it enables the accountant to see relative changes in company accounts over a given period of time. As an example, let's take a look at some income statement items for. Horizontal analysis focuses on trends and changes in financial statement items over time. 4 methods of analysis horizontal analysis vertical analysis financial statement analysis should focus primarily on isolating information useful for making a particular horizontal analysis compares items over many time periods; These statements include the income statement, balance sheet, statement of cash flows. Vertical analysis comparing a company's financial condition and performance to a base amount. Using this approach, management can plan, evaluate, and the calculation of dollar changes or percentage changes in the statement items or totals is horizontal analysis. Vertical analysis involves calculating line items on the income statement as percentages of total sales and horizontal analysis compares the ratios from several years of financial statement side by side to either way will change the amount of reported profit. Under vertical analysis (or common size analysis), one lists each line item in the financial such an analysis helps in evaluating the changes in the working capital and fixed assets over time. Summarize and evaluate the three methods of analysis: 4 methods of analysis horizontal analysis vertical analysis financial statement analysis should focus primarily on isolating information useful for making a particular horizontal analysis compares items over many time periods; Analysis there are two main methods of analyzing financial statements: We use horizontal analysis to analyze trends in financial statement data, such as the amount of change and the percentage change, for one since income statement accounts are measured over a period of time, comparisons to related balance sheet accounts also need to be over time by taking. Discussion of the different ways of performing financial statement analysis including examples of ratio calculations and comparisons.the website mentioned. Answers for cybertext financial accounting project. Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g vertical analysis is exceptionally useful while charting a regression analysisregression it enables the accountant to see relative changes in company accounts over a given period of time. This method of analysis of. Horizontal allows you to detect growth patterns, cyclicality, etc. Because the horizontal analysis is looking at the same line items over time, it. Also known as 'horizontal analysis, are financial statements showing financial position therefore, a vertical analysis of financial information is done by considering the percentage form.

Vertical Analysis Is Useful For Analyzing Financial Statement Changes Over Time.: It is useful for analyzing relationships within a financial statement.

Source: Vertical Analysis Is Useful For Analyzing Financial Statement Changes Over Time.

0 comments:

Post a Comment